-

Aella: Savings, Loans, Bills

- Category:Finance

- Updated:2024-09-21

- Rating: 4.4

- Parent

Introduction

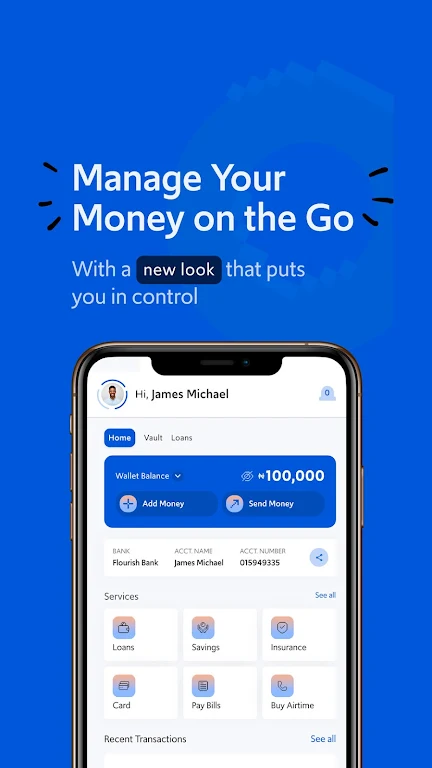

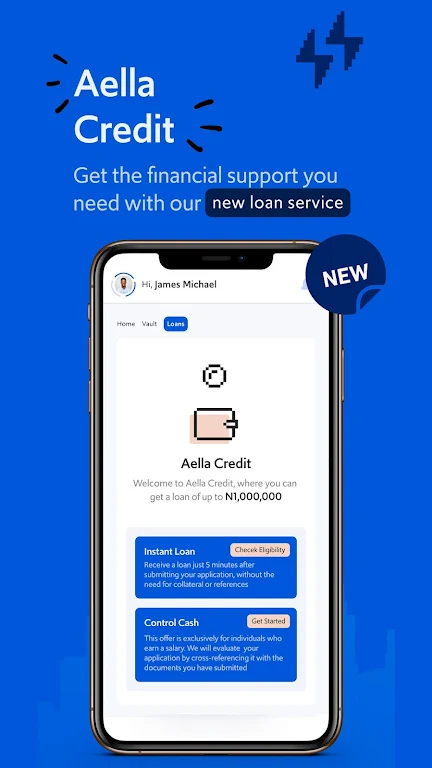

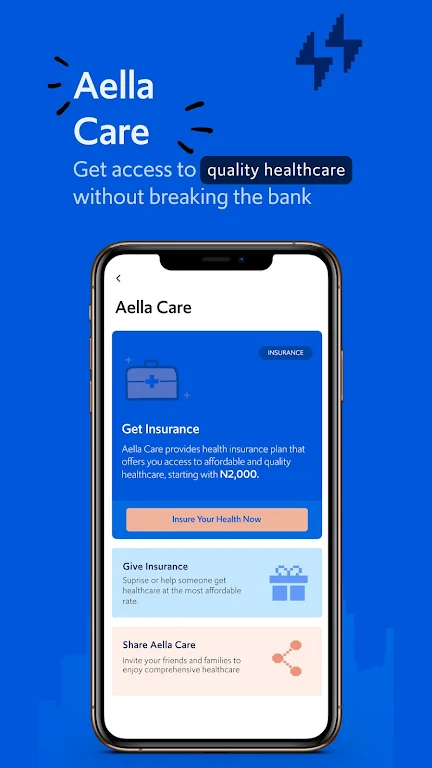

Introducing Aella: Savings, Loans, Bills: the ultimate app for all your financial needs. Say goodbye to the hassle of paperwork and long waiting periods because with the app, you can access instant credit and payment solutions in just a matter of minutes. Whether you need a loan, want to invest, pay bills, get micro-insurance plans, or transfer money, the app has got you covered. With Aella Credit, you can easily apply for a loan ranging from ₦2,000 to ₦1,500,000 with a repayment period of 61 days to 365 days. Plus, our interest rates are incredibly competitive, starting from as low as 2%. When it comes to loans, the app is the name you can trust. But that's not all, with Aella Pay, bill payments have never been easier. From airtime and power bills to internet data and transfers, you can conveniently make all your payments without any extra charges.

Features of Aella: Savings, Loans, Bills:

* Quick and easy access to loans: The app offers a seamless loan application process that can be completed in just 5 minutes. With no paper documentation required, users can easily apply for a loan and receive funds instantly.

* Competitive interest rates and fees: The app offers competitive interest rates, ranging from 2% to 20% per month, and APRs from 22% to 264% per annum. Additionally, there are no hidden fees or late penalties, allowing users to confidently manage their loan repayments.

* Early repayment discounts: Users have the opportunity to make early repayments at any point during their loan tenor, and receive discounts of up to 60%. This incentivizes responsible borrowing and helps users save money on interest charges.

FAQs:

* How long does it take to receive funds after loan approval?

Upon loan approval, funds are instantly disbursed to the user's Aella: Savings, Loans, Bills App account.

* Is there a minimum credit score requirement to be eligible for a loan?

No, a minimum credit score is not required. However, users are encouraged to provide accurate basic information and maintain prompt repayments to increase their credit limit.

* Can I make early repayments on my loan?

Yes, the app allows users to make early repayments at any point during their loan tenor. This provides flexibility and the opportunity to save on interest charges.

Conclusion:

With Aella: Savings, Loans, Bills app, individuals in emerging markets can easily access loans, make bill payments, and enjoy other financial services. The app offers quick loan approvals, flexibility in loan terms, competitive interest rates, and the option for early repayment discounts. By simplifying the loan process and providing transparent terms, the app empowers users with the tools they need to achieve financial independence. Download today to experience the convenience and benefits it offers.

Information

- Size: 19.60 M

- Language: English

- Version: 9.12.1

- Requirements: Android

- Ratings: 336

- Package ID: com.aella.comportal

- Developer: Aella Financial Solutions Limited