-

FlexPay: Personal Loan App

- Category:Finance

- Updated:2024-09-21

- Rating: 4

- Food

Introduction

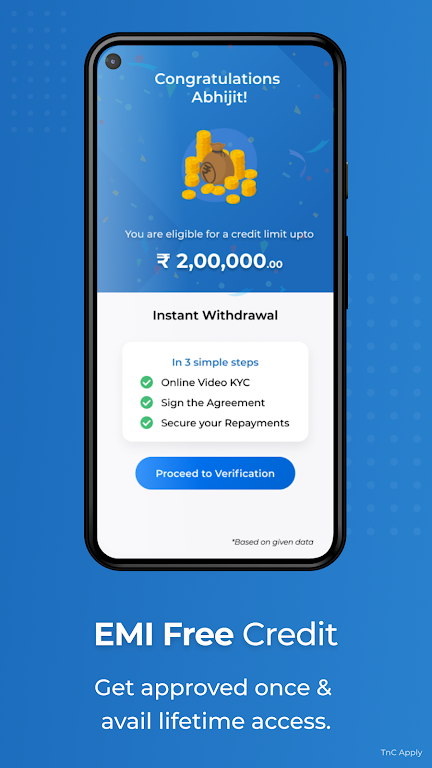

Looking for a quick and hassle-free way to get a personal loan? Look no further than FlexPay: Personal Loan App! This innovative app is designed to simplify your life by offering instant access to credit and a simple loan application process. With the app, you can apply for a loan of up to 3 lakhs online and receive instant cash in your bank account on the same day, if you meet the eligibility criteria. Whether you need money for your groceries, food, medicines, or even bike service, the app has got you covered. Just use your smartphone to make the purchase and pay later at your convenience. It's never been easier to get the funds you need, when you need them. Join the thousands of satisfied customers and experience the convenience of the app today!

Features of FlexPay: Personal Loan App:

❤ Instant Credit Line: The app offers customers a line of credit of up to 3 lakhs, providing instant access to credit whenever they need it.

❤ Simple & Quick Application Process: FlexPay's loan application process is designed to be user-friendly and efficient, allowing users to apply for a loan quickly and easily through the app.

❤ Scan-now Pay-later Option: The app allows users to make purchases using their credit line and pay for them later at their convenience, offering a convenient and flexible payment option.

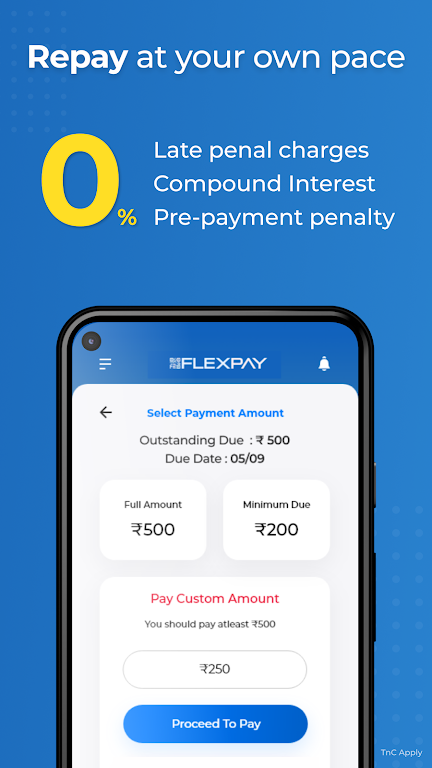

❤ No Hidden Fees and Penalties: The app guarantees no hidden fees, bounce cheque fees, or prepayment penalties, providing transparency and fairness to its users.

Tips for Users:

❤ Decide on the Loan Amount: Before applying for a loan using the app, determine the exact amount you need to borrow to meet your financial needs. This will help you avoid borrowing more than necessary and incurring unnecessary interest charges.

❤ Calculate Monthly Repayments: Use the app's loan calculator to estimate the monthly repayment amount based on your loan amount and repayment tenure. This will give you a clear idea of the financial commitment involved and help you plan your budget accordingly.

❤ Read and Understand the Terms and Conditions: Before finalizing your loan application, make sure to carefully read and understand the terms and conditions of the loan agreement. Pay attention to the interest rate, processing fees, and any other relevant charges to ensure there are no surprises later on.

Conclusion:

FlexPay: Personal Loan App is the ideal personal loan app for individuals in India who are looking for instant credit and a hassle-free loan application process. With its user-friendly features, such as instant access to credit, a simple application process, and the option to scan items and pay later, the app offers convenience and flexibility to its users. By adhering to its transparent policies of no hidden fees or penalties, the app aims to provide a trustworthy and reliable lending solution to its customers. Download the app today and experience the ease of borrowing and repaying loans in a seamless manner.

Information

- Size: 34.50 M

- Language: English

- Version: 4.9

- Requirements: Android

- Ratings: 219

- Package ID: in.india.upi.flexpay

- Developer: VIVIFI - Instant Personal Loan & Online Loan App