-

TATA Capital Loan App & Wealth

- Category:Finance

- Updated:2024-10-15

- Rating: 4.3

- Finance

Introduction

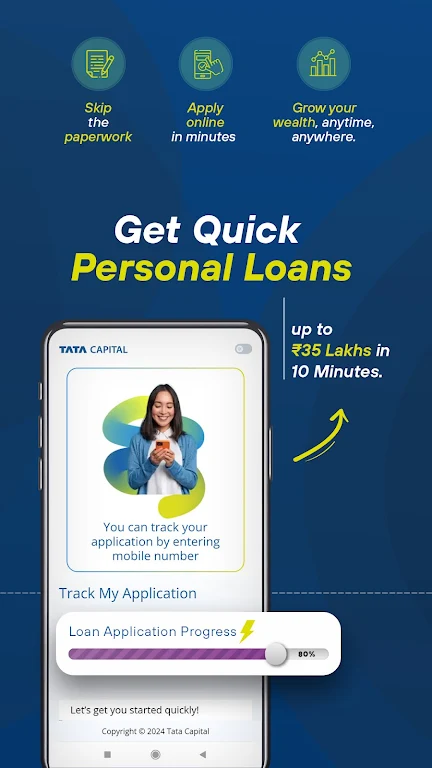

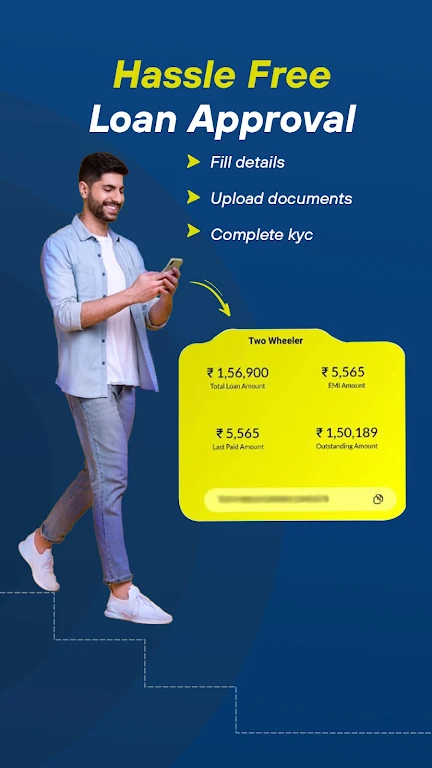

Introducing the TATA Capital Loan App & Wealth App, your go-to solution for all your financial needs. This app is more than just a personal loan app - it's a comprehensive wealth management tool. With just a few taps, you can apply for personal loans ranging from ₹5,000 to ₹10,00,000 at attractive interest rates starting from 10.99%. The app also offers transparent processing fees and flexible repayment tenures. But that's not all - you can also access business loans, home loans, and vehicle loans through this app. Plan your EMIs, estimate your repayments, and enjoy swift processing and approval. It's time to take control of your finances with the App.

Features of TATA Capital Loan App & Wealth:

⭐ Instant and Convenient: The app offers instant personal loans and a seamless wealth management experience. With just a few taps, users can apply for personal loans ranging from ₹5,000 to ₹10,00,000, eliminating the hassle of visiting physical branches and undergoing lengthy approval processes.

⭐ Competitive Interest Rates: The app provides attractive interest rates starting at 10.99%, making it a cost-effective solution for borrowing money. Users can enjoy affordable EMIs and minimize the financial burden of loan repayments.

⭐ Flexible Repayment Options: TATA Capital understands the diverse financial needs of its users and offers flexible repayment tenures ranging from 12 to 84 months. This allows borrowers to customize their loan repayment schedules based on their financial capabilities.

⭐ Transparent Processing Fees: The app ensures transparency by providing clear information about processing fees. Starting at ₹1,499 + GST, users can have a complete understanding of the costs associated with their loan applications.

Tips for Users:

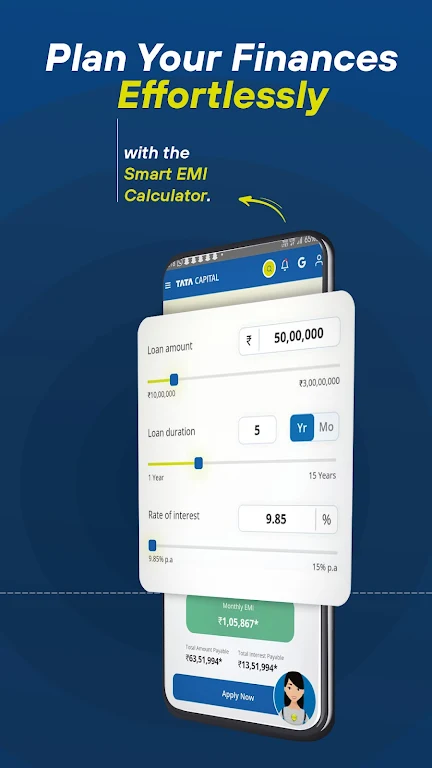

⭐ Plan Your Repayments: Utilize the personal loan EMI calculator available on the app to plan your loan repayments effectively. By inputting the loan amount, tenure, and interest rate, you can get an accurate estimate of your monthly EMIs and the total repayment amount.

⭐ Estimate Your EMI in Advance: When applying for a business loan, use the app's business loan EMI calculator to estimate your monthly EMI in advance. This will help you assess whether the loan is affordable for your business and assist in financial planning.

⭐ Explore Loan Tenure Options: Take advantage of the app's flexible loan tenure options for home loans. Evaluate different tenure options (up to 30 years) to determine the most suitable repayment schedule that aligns with your financial goals and capabilities.

Conclusion:

The TATA Capital Loan App & Wealth App offers a wide range of features and benefits to cater to various financial needs. With its instant personal loans, attractive interest rates, and flexible repayment options, the app makes borrowing money quick and convenient. Whether you need funds for your business, dream home, or vehicle, the app provides a seamless and transparent experience. Use the available EMI calculators to plan your repayments in advance and navigate your loan journey with confidence. Experience the ease and efficiency of TATA Capital's loan and wealth management solutions by downloading the app today.

Information

- Size: 120.00 M

- Language: English

- Version: 2.4.6

- Requirements: Android

- Ratings: 149

- Package ID: com.snapwork.tcl

- Developer: Tata Capital

Explore More

Top Downloads

Related Apps

Latest Update