-

Lendtek: Small Business Loans

- Category:Finance

- Updated:2024-10-15

- Rating: 4

- Parent

Introduction

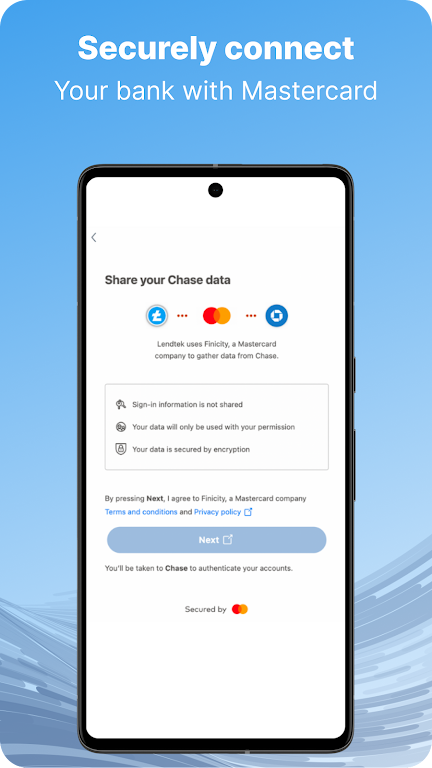

Need a business loan? Look no further than the Lendtek: Small Business Loans app. With over 65 high-quality lenders to choose from, you can easily compare and select the best loan options for your business. The best part? It's completely free and won't impact your credit score. Lendtek's advanced technology matches your business profile to multiple lenders, giving you transparent and diverse loan options. Whether you need a term loan, line of credit, or equipment financing, the app has got you covered. Plus, with trusted partners like American Express and Experian, you can feel confident in the security and reliability of the app.

Features of Lendtek: Small Business Loans:

> Multiple Loan Options: The app offers a wide range of business loan options, including SBA loans, term loans, line of credit, equipment financing, invoicing factoring, merchant cash advance, account receivables financing, and collateralized lending. This makes it a one-stop shop for all your business financing needs.

> Transparent Comparison: The Lendtek mobile app matches your business profile with over 65 high-quality lenders. You can compare the product, rate, term, and funded amount easily and transparently. This allows you to make an educated decision and choose the best business loan option for your specific needs.

> Easy Application Process: With Lendtek, applying for a business loan is simple and hassle-free. You can apply directly through the mobile app and upload any required documents directly in the client portal. This saves time and eliminates the need for tedious paperwork.

> Convenient Fund Withdrawal: Once approved for a loan, you can withdraw funds at any time and from anywhere. This flexibility allows you to have quick access to the funds you need to grow and manage your business.

Tips for Users:

> Research Loan Options: Take advantage of Lendtek's extensive product line by researching and understanding the different loan options available. This will help you choose the loan product that aligns best with your business goals and financial needs.

> Compare Rates and Terms: Use the Lendtek mobile app to compare the rates and terms offered by different lenders. Consider factors such as interest rates, repayment terms, and any additional fees. This will help you select the most cost-effective loan option for your business.

> Prepare Required Documents: Before applying for a loan, gather all the necessary documents and upload them directly in the app. This will streamline the application process and ensure a faster approval.

Conclusion:

Lendtek: Small Business Loans is the ultimate solution for small business owners in need of financing. With its diverse product line and user-friendly mobile app, the app simplifies the loan application process and empowers business owners to make informed decisions. The transparent comparison feature allows you to choose the best loan option for your business needs, while the convenient fund withdrawal ensures quick access to capital. With an A+ rating from the BBB and a 5-star rating on app stores, the app has earned the trust of businesses nationwide. Download the mobile app today and take control of your business's financial future.

Information

- Size: 31.90 M

- Language: English

- Version: 1.3

- Requirements: Android

- Ratings: 448

- Package ID: com.app.lenddtekk

- Developer: Lendtek®

Explore More

Top Downloads

Related Apps

Latest Update