-

Tomorrow: Mobile Banking

- Category:Finance

- Updated:2024-09-21

- Rating: 4.5

- Finance

Introduction

Join the ever-growing Tomorrow: Mobile Banking community and experience the future of mobile banking. Tomorrow: Mobile Banking app is not just your ordinary banking app - it's a platform that allows you to support sustainable projects with your everyday finances. With the app, you can easily open an account in minutes and gain control over your spending with the monthly summary feature. You can also organize your finances and save money with sub-accounts called Pockets, while enjoying the convenience of shared account management with a partner. Plus, enjoy free real-time transfers, quick mobile payments with Google Pay, and access to a free Visa debit card that can be used worldwide. Your money and data are also protected, with national deposit insurance and strict adherence to privacy rules. But what sets the app apart is its commitment to sustainability. Instead of supporting harmful industries, the app exclusively invests in sustainable industries, helping to create a better future for us all.

Features of Tomorrow: Mobile Banking:

> Sustainable Investing: The app sets itself apart from conventional banks by exclusively investing in sustainable industries. By opening an account with the app, you can ensure that your money is being used to support initiatives that align with your values.

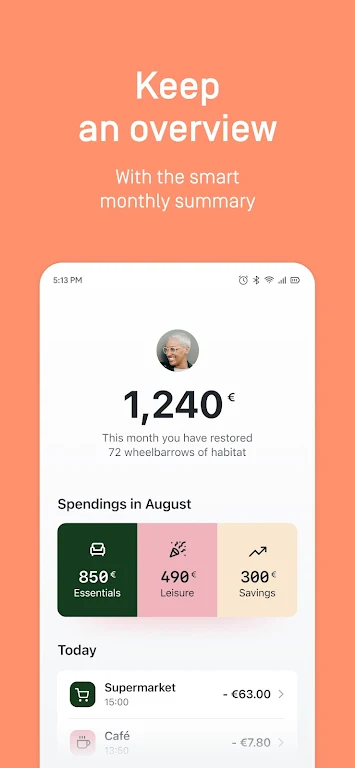

> Monthly Summary: The app provides a monthly summary of your spending, giving you a quick overview of your financial habits. This feature allows you to track your expenses and gain more control over your finances.

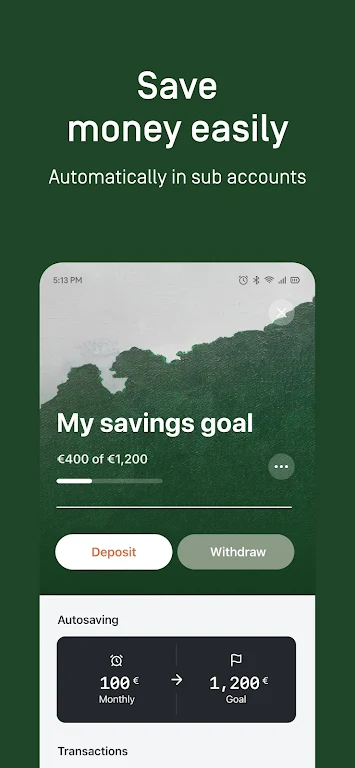

> Sub Accounts: With the app's Pockets feature, you can easily organize your finances and save money. This allows you to set aside funds for specific purposes, such as a vacation or emergency fund, making it easier to manage your financial goals.

> Shared Account: The app offers a premium feature that allows you to manage your money together with another person. This is ideal for couples or families who want to have joint control over their finances and easily track their shared expenses.

Tips for Users:

> Utilize the Monthly Summary: Take advantage of the monthly summary feature to gain insights into your spending habits. This can help you identify areas where you can cut back and save money.

> Maximize Sub Accounts: Take full advantage of the app's Pockets feature by creating multiple sub accounts for different savings goals. Whether it's saving for a home or a new car, allocating funds to specific pockets will help you stay on track.

> Share Expenses with a Partner: If you opt for the premium shared account feature, make sure to communicate with your partner about your shared expenses. This will ensure that both of you are on the same page and can easily manage your finances together.

Conclusion:

Tomorrow: Mobile Banking is not just another banking app; it offers a unique opportunity to align your financial habits with your values. By investing exclusively in sustainable industries, the app stands apart from traditional banks that may support harmful industries. With features such as a monthly summary, sub accounts, and the option for a shared account, the app provides a seamless and customizable banking experience. Furthermore, by choosing the app, you can contribute to the restoration of valuable habitats through your everyday purchases. Open your the app account today and join the growing community of individuals committed to a more sustainable future.

Information

- Size: 48.80 M

- Language: English

- Version: 3.61.0

- Requirements: Android

- Ratings: 325

- Package ID: one.tomorrow.app

- Developer: Tomorrow GmbH

Explore More

Top Downloads

Related Apps

Latest Update